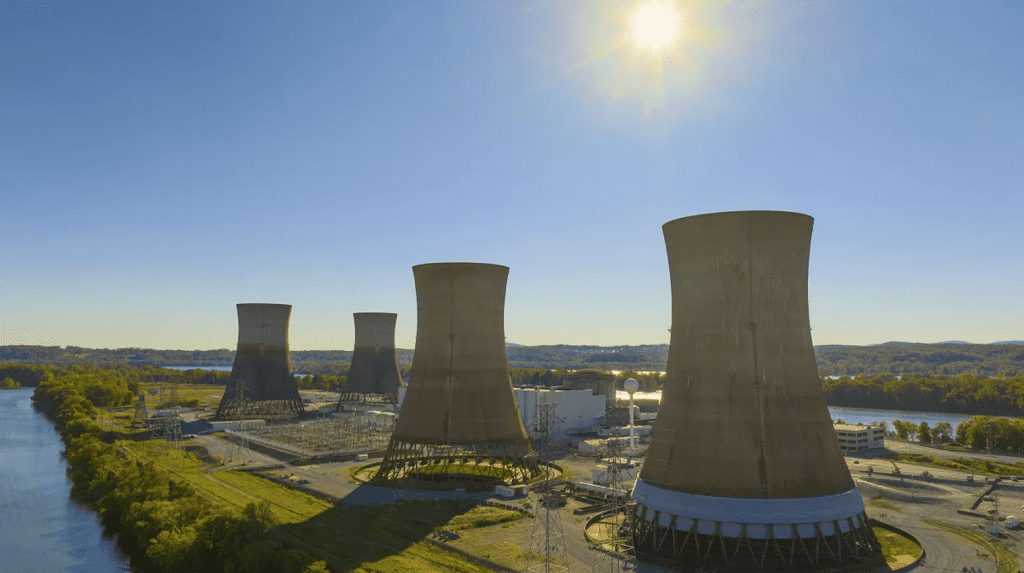

Following our last blog post (U.S. Nuclear Industry to Get a Major Boost: Great News for AI), we wanted to look at just how industry experts see nuclear energy playing an important role in projected energy needs in the U.S. – but, more than that, how can our country’s electrical grid be expected to handle the much-talked-about growth of artificial intelligence (AI), which relies heavily on data centers to deliver? After all, we’re all about AI here at Timmaron Group.

In this post, we also set out to explore two more questions: What advantages does nuclear have over other energy sources? And how has nuclear progressed?

First, some key stats and predictions. In a recent Reuters article, we learn that data center demand is pushing U.S. power consumption to record highs in 2025 and 2026. And an April article in Utility Dive reported that U.S. electricity demand will grow 50% by 2050. That’s shocking enough, 25 years into the future, but how about just five years out? IEA said in a recent report that it expects the demand for data center electricity alone to double by 2030. That is a significant growth prediction indeed.

How can the country’s electrical grid keep up? First, let’s look at a breakdown of the current U.S. grid mix (2023):

• Natural Gas: 43 %

• Coal: 16 %

• Nuclear: 19 %

• Wind: 10 %

• Hydro: 6 %

• Solar: 4 %

• Biomass: 1 %

• Other (oil, etc.): <1 %

But what could that breakdown be by 2040? What energy sources are expected to contribute to the increased demand? Below is a projected breakdown based on a number of factors. Those factors are as follows (according to multiple sources via ChatGPT): the current Administration’s executive orders targeting a 4X increase in nuclear capacity (from ~100 GW today to 400 GW by 2050), with 10 new large reactors by 2030 and pilot advanced reactors by 2026; the build-out of Small Modular Reactors (SMRs) reaching ~50 GW by 2040; federal support for uprates of existing reactors (~5 GW), plus fuel-cycle and licensing reforms; and strong private-sector momentum (Westinghouse $75 B investment, Oklo/Standard Nuclear/Meta deals, and Cameco fuel investments, etc.).

Projected breakdown by 2040:

• Nuclear 35% (Large reactors + SMRs)

• Natural Gas 30%

• Coal 10%

• Wind 12%

• Solar 7%

• Hydro 5%

• Biomass 1%

In a September 2024 report entitled, Data centers and AI: How the energy sector can meet power demand, McKinsey wrote, “To keep pace with the current rate of adoption, the power needs of data centers are expected to grow to about three times higher than current capacity by the end of the decade, going from between 3 and 4 percent of total US power demand today to between 11 and 12 percent in 2030.” The firm goes on to say, “Without ample investments in data centers and power infrastructure, the potential of AI will not be fully realized.” The article addresses the prospective growth of AI and demand for data centers, the challenges to scaling data centers, and how investors and incumbents could realize significant gains while helping fulfill AI’s potential.

Another, more recent report from Deloitte addresses nuclear power specifically, citing how “new nuclear power” will play a significant role. It expects data centers to consume about 30% of this new nuclear capacity that is added over the next decade, through a combination of power uprates at operational plants, restarts of recently-retired reactors, and new reactor deployments at greenfield and existing power plant sites.

“New nuclear is likely to find a niche as a reliable source of increasingly cost-competitive baseload power,” said Martin Stansbury, report co-author and principal at Deloitte. “Small Modular Reactors have a major role to play in future grid reliability.” These SMRs, he noted, have additional benefits for data centers in particular, including more secure fuel forms, self-starting and grid “islanding” capabilities, and the ability to operate continuously for long periods of time.

But existing nuclear and coal-fired power plants could also support much of the new generation capacity the U.S. data center industry needs in the coming decade. And it notes that at least 11 states have expressed interest in supporting coal-to-nuclear conversions.

What advantages does nuclear have over other energy sources?

The utility industry recognizes that nuclear energy has several advantages, including:

• Grid reliability – with 24/7 consistent output, unlike wind or solar, making it ideal for meeting steady energy demands and supporting data centers or industrial load.

• Emissions — Nuclear plants emit no CO₂ during operation. Over a lifecycle, nuclear has lower carbon intensity than solar, wind, and fossil fuels.

• Land use – nuclear requires far less land than wind or solar per unit of energy produced. Example: 1 GW of nuclear requires about one square mile. The same with solar requires 75–100 square miles.

In addition, nuclear supports energy independence, as it reduces reliance on foreign oil, gas, or rare minerals used in solar panels and batteries. Finally, there’s the factor of next generation reactor potential. Small Modular Reactors (SMRs) offer safer, cheaper, and more flexible deployment. And new designs can use spent fuel, reducing nuclear waste.

Net-net, nuclear offers reliability, zero-carbon emissions, and compact scalability — especially valuable in a high-demand, AI-driven, electrified future. When paired with renewables, it forms a powerful clean energy backbone.

How Has Nuclear Progressed From Its Earlier Days?

Key improvements as we enter a new generation in nuclear energy can be summarized as follows:

• Before: manually operated. Now: digitally controlled and automated.

• Before: large, custom-built plants. Now: factory-produced SMRs and microreactors.

• Before: high waste concern. Now: fuel recycling and lower-waste designs emerging.

• Before: public skepticism. Now: renewed support as a better climate solution.

Conclusion – Time to Take Action

Nuclear has transformed from a Cold War-era novelty to a next-generation clean power backbone, with new technologies like SMRs and advanced reactors offering safer, cheaper, and more flexible deployment options. Its role in supporting data centers and AI, we believe, is more important than ever.

Timmaron Group has experience working with utility industry clients going back to 2010, and we look forward to working toward the goal of building an expanded, nuclear-enabled electrical grid that will allow the U.S. to realize the full potential of AI.

Are you considering getting involved? If so, we’d love to talk.

Also, please note that Timmaron Group people are attending the upcoming HP Enterprise (HPE) Discover annual partner conference, where will be focusing on our collaborative synergy surrounding community health, industrial manufacturing and supply chain, and our shared space program work with Starlink. Ask us about any of those initiatives!

Please reach out today by contacting us at hi@timmarongroup.com.